Since our previous article on “What’s the process for a Sunshine Coast Roof Insurance Claim?” was so popular, we’ve decided to continue along the theme to ensure you have all the information when it comes to ‘insurance works’ – with the top 5 roof replacement and roof repair jobs covered by your insurer.

Since our establishment in 1993, our experienced and qualified teams have conducted hundreds of roof insurance works on residential homes and commercial properties across Australia. Having worked with a wide range of Australian insurance providers, there are a few common trends we’ve identified for the outcome of most roof insurance claims, repairs and roof replacements.

So, if you’re interested in finding out what is typically covered under roofing insurance plans, continue reading on!

FIVE CATEGORIES COVERED BY YOUR INSURER

While, there are hundreds of providers, policies and product disclosure agreements (all of which is subjected to each individual), here are five common roofing claims that are covered by insurers.

It is quite typical for most insurance companies to cover damage to your roof or gutters *if* the damage was caused by a storm (fallen trees, uplift & hail damage), fire, burglary, vandals or accidental damage.

While damages caused by storms, fire, burglary or vandalism is quite self-explanatory, the term accidental damage can include various situations. A few examples could be:

- An old tree falling onto your roof

- An electrical fault or fire

- Strong winds

ROOFING REPLACEMENT MISCONCEPTIONS

Now, it’s important to note a few misconceptions when it comes to any of the five category’s listed above. Your insurer WILL NOT cover any claims for gradual wear and tear or your lack of maintenance.

For example, if you’re claiming water damage from a recent storm, you need to ask yourself, “Did the storm create the issue or was the issue there, and I’ve only just noticed the leak.”

It’s not always easy to determine how a leak is caused, which is where a Capricorn Roofing expert can inspect your roof to determine what damages will be covered.

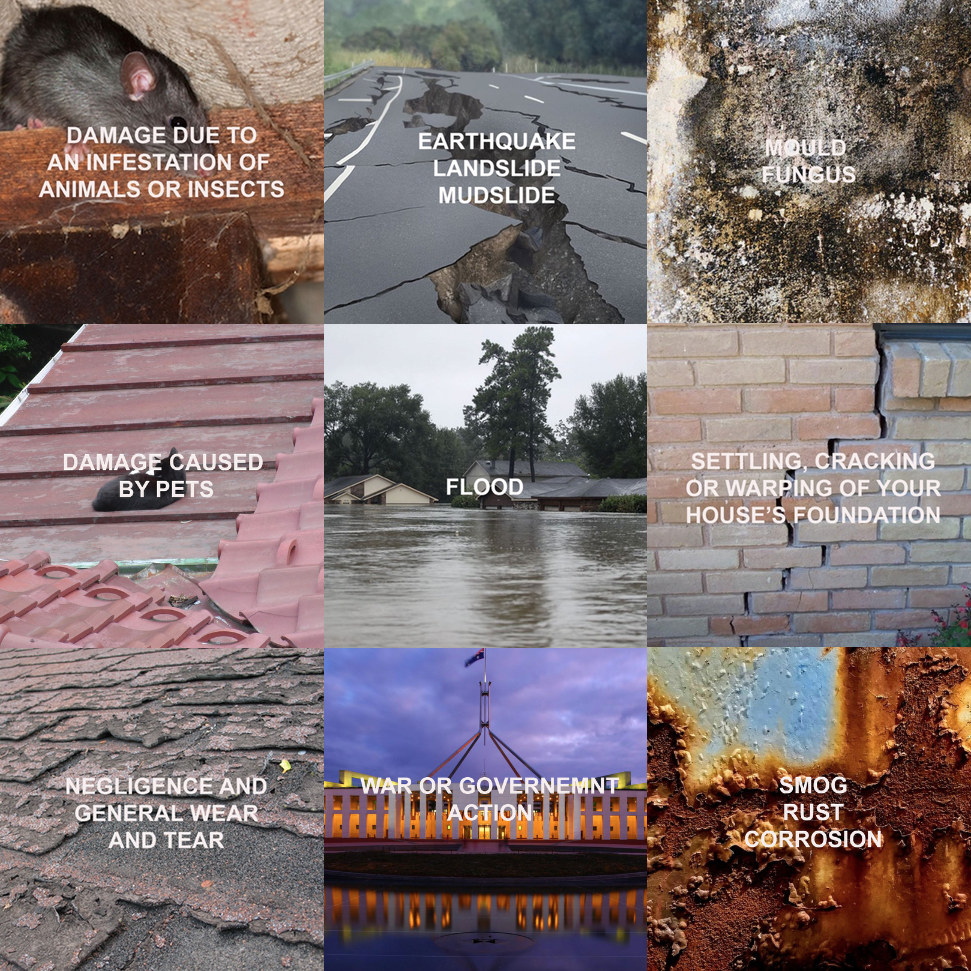

EXCLUDED ROOF REPAIR HAZARDS

Below is a list of hazards which are also typically excluded from roof insurance plans. We’d advise that you check this with your provider. If you desire coverage for one of these hazards, you can usually add supplemental coverage to your policy in the form of an optional endorsement.

FAULTY WORKMANSHIP

Having worked within the roofing industry for over 15 years, we’ve noticed an unfortunate trend where newer homes less than ten years old are requiring more roof repairs and maintenance than ever before. Generally speaking, maintenance is required after 15 – 20 years, and it’s apparent that the result is caused by rushed projects, faulty workmanship and dodgy repair designs.

This is where workmanship guarantees and product insurance offers (no less than ten years) is recommended to ensure you’re not dealing with unprofessional or underqualified roofing businesses.

Insurance companies WILL NOT cover these sorts of issues, especially if it is found that your roof doesn’t comply with Australian building regulations and standards. So, how do you find out if this is the case? You can contact Capricorn Roofing directly for an independent roof report or contact your insurance provider directly.

WHAT’S NEXT?

Whether it’s through an insurer or private repair, Capricorn Roofing can assist you with a wide range of maintenance, repair or roof replacement services. Simply email our team your roof report, assessment or general enquiry to info@capricornroofing.com.au and we can provide tailored advice for your roofing needs.